FACING FINANCIAL DISTRESS IN THE CANNABIS INDUSTRY BY LEVERAGING STRATEGIC TRANSFORMATION, RESTRUCTURING AND RECEIVERSHIP

With legalization now spreading across the majority of the United States, the Cannabis industry has experienced exponential growth. While ripe with potential, it presents unique challenges as it continues to evolve. As businesses mature within this sector, financial obstacles have emerged necessitating strategic transformative shifts and forcing restructuring to ensure viability.

What is Transformation, Restructuring, and Receivership?

"The Cannabis industry is becoming more sophisticated

with Investment Bankers,

PE-Firms, and MBA's managing large scale vertically integrated shops.

If you are not prioritizing a culture of continuous process improvement, built on an effective transformation program that can influence rapid changes when opportunities or troubles arise, you will lose."

"You grow your business by expanding your service or product offerings or by delivering more value in existing products or services so that you meet your customers' needs where they are, at the right time, at the right price.

When you fail to properly identify your customer, understand the customer needs, and deliver a differentiated solution you become a commodity.

For example, a wholesale cultivations customer is the dispensary partner and not the consumer. How do you create a differentiated experience for your dispensary partners that ensures you maintain and expand shelf space?"

Think of transformation as the process of evolving your business when shifts in the marketplace occur. Managing this process allows your business to prosper and navigate through troubled waters in a manner that is accretive and protective.

How well is your business positioned to pivot on a dime and avoid being disintermediated by a nimbler marketplace participant? Do you have your action plan primed and tested to ensure you stay focused on your fundamentals while driving change? Do you even know where to start?There are many fortunate and unfortunate reasons to start a transformative process!

Perhaps your business is pursuing new growth opportunities, new automation technologies, new and emerging markets to explore. Perhaps, your competitors are expanding faster than you, they are producing at a lower cost per unit, they have lower sale prices, they have better brand awareness, or perhaps you don't have the financial resources to compete.

By having the team in place that can evaluate the marketplace, talk frankly with your stakeholders, assess your offerings absent bias and that can move quickly to implement changes you can increase the probability that you successfully lead your business towards your desired outcomes.

Think of transformation as the process of evolving your business when shifts in the marketplace occur. Managing this process allows your business to prosper and navigate through troubled waters in a manner that is accretive and protective.

There are many fortunate and unfortunate reasons to start a transformative process!

Perhaps your business is pursuing new growth opportunities, new automation technologies, new and emerging markets to explore. Perhaps, your competitors are expanding faster than you, they are producing at a lower cost per unit, they have lower sale prices, they have better brand awareness, or perhaps you don't have the financial resources to compete.

By having the team in place that can evaluate the marketplace, talk frankly with your stakeholders, assess your offerings absent bias and that can move quickly to implement changes you can increase the probability that you successfully lead your business towards your desired outcomes.

Restructuring is a tool in your transformation toolbox. Any restructuring starts by an evaluation of the current state and asking the question WHY.

Why do our customers buy or choose not to buy our offerings? Why do employees choose to work with us? Why are our competitors outperforming us? Why do we need to change? What is the desired outcome of the change? What are the internal and external dependencies? Who will be impacted by the change? Who can be and lead your change agents?

You want to pinpoint the population of tasks inside your business that need to change or be built to achieve your desired outcome.

There is significant work that goes into planning restructuring activities that includes (a) understanding the business problem, (b) understanding what the processes need to be built or changed, (c) identifying the customers of the process and engaging them in the change process, (d) researching alternative solutions, (e) obtaining entity wide buy in, (f) resourcing, communicating and managing the change, (g) establishing performance metrics and goals, and (h) re-evaluating whether the process worked as planned.

All this work to identify the population of actual tasks that you need to change, determine and empower the proper change management team, and establish a change communication strategy designed to drive your business forward.

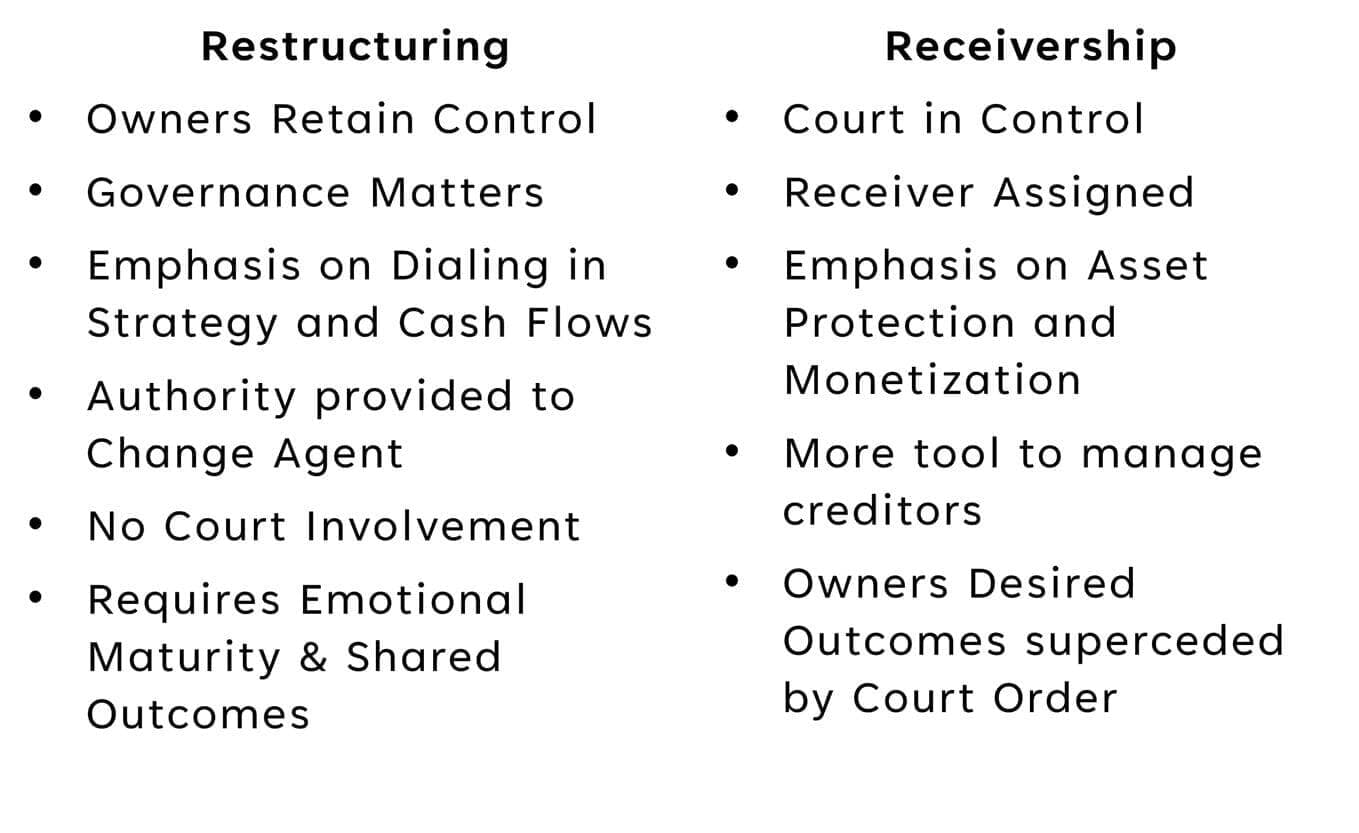

Ultimately, the goal is to have a stable change management process in place that allows you to read the tea leaves and make nimble changes to your business. Demonstrating your ability to thrive in any environment garnering trust amongst your stakeholders (investors, landlords, debtors, employees, etc.) or help to avoid receivership.

Receivership is another tool that can be leveraged by Cannabis businesses. Bankruptcy is generally not a viable option due to federal illegality. Receivership is run by the State Court System governed by a Court Order. The Court order will designate a court receiver empowered to manage, protect, and monetizing the assets of the business.

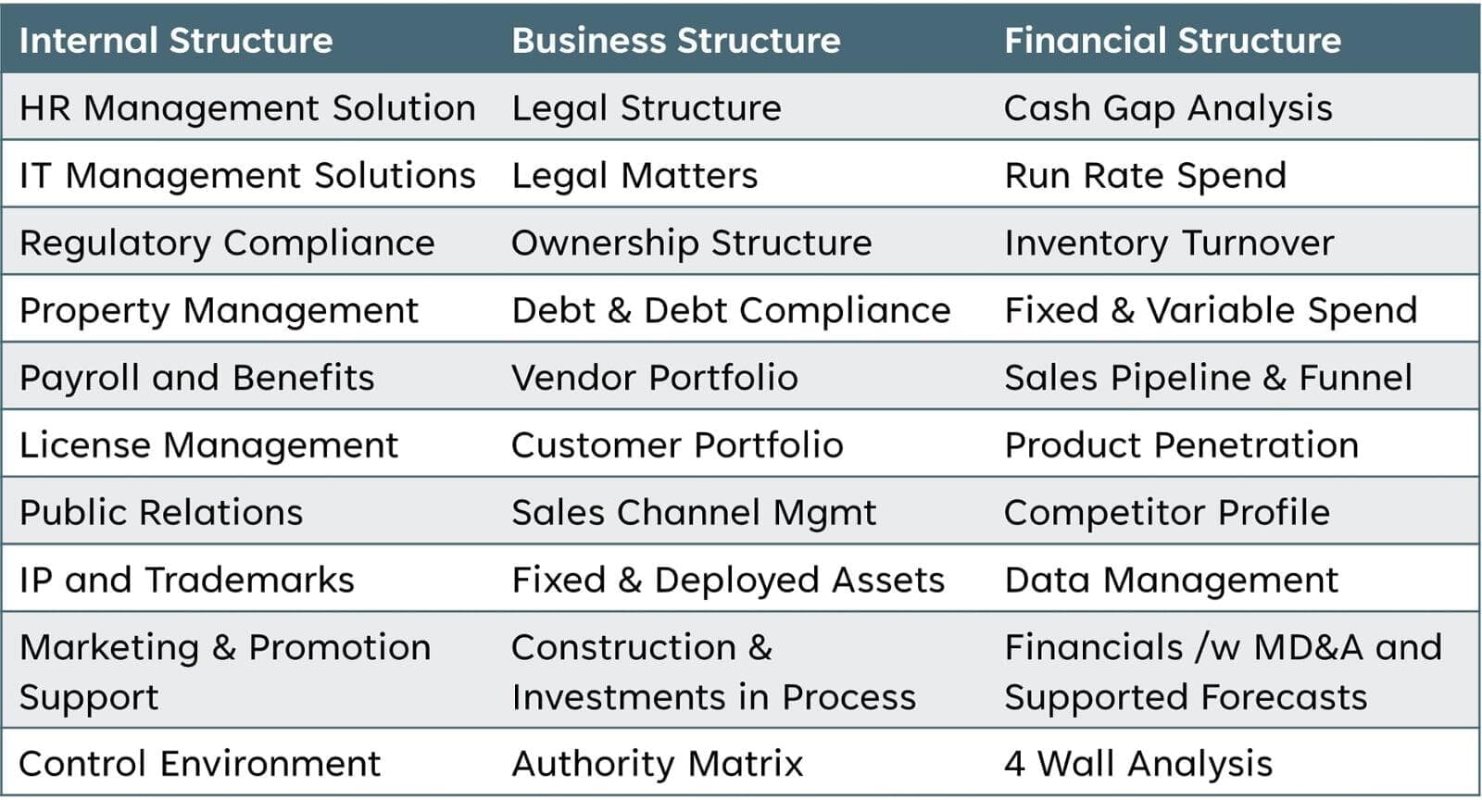

Gathering Your Information into Digestible Building Blocks!

Create the data room up-front, go through the information, identify both risk and opportunities in a manner that allows others to quickly understand your playing field. While this information may be generally understood by the leadership team, when working through transformation, restructuring or receivership the ability to contractually validate truths is critical!

Taking the First Step! Cannabis is an emerging industry, led by entrepreneurs, that were securing capital while building sales channels and dealing with the daily ebbs and flows of business culture. As a result, the centralization and documentation of business information is often lacking.

What is your relevant business information?

It is comprised of customer and vendor contracts, leases, cap table, operating agreements, cultivation services agreements, legal entity org charts, employment agreements, IP trademarks, Standard Operating Procedures, previously issued financials with analysis, hand-shake arrangements, credit and payment histories, loyalty programs, strategic assessments, customer data, competitor data, branding, etc.

In most cannabis businesses, this information is spread across multiple laptops of executives, in multiple cloud storage services, and perhaps retained as attachments in your QBO environment.

The better your information is organized, retained, and democratized the better the information can be used as a strategic advantage.

Build Your

Comprehensive Business Evaluation

Before implementing a transformation project, restructuring or pursuing receivership, you must conduct a thorough assessment of your business situation. This is part of planning!

You know your business better than anyone, so now it's time to document that business understanding in a comprehensive manner that highlights why and how decisions were made and what alternatives have been considered. This allows you to clearly and confidently tell the transparent and verifiable story of your journey, accomplishments, potential future outcomes, and known challenges.

Being prepared in this way helps others want to help you. It garners a great deal of confidence between stakeholder groups when communicated timely and effectively.

Before you voluntarily submit to a receiver, hire a restructuring team! Your restructuring team should be authorized by the owners to make dramatic changes as necessary to secure the financial position of the Company in partnership with you and geared to addressing the needs of all your stakeholders.

The restructuring team can roadmap out a change process that engages your team and minimize the fear factor of key employees, vendors, and potentially customers. Leveraging change control and project management strategies will increase the potential for success and help to avoid needing receivership.

Once a plan is in motion, do not become a road blocker! Some or all your employees will reach out to you in fear of the impeding change, so be clear that you are on-board with the changes and that they should be as well. Encourage your employees to openly communicate the good, the bad and the ugly to the restructuring team. This is the time for them to share their ideas and shape the future of the business. Your role is to listen, understand, ask questions, and provide advice but not to slow down an agreed upon restructuring plan.

This type of proactive approach is also advisable from a legal perspective as a potential mechanism to argue against an involuntary receiver assignment. By demonstrating that existing management is already taking significant actions to address the needs of the business.

AMOS has led several businesses through this process and has helped both large and small businesses in various industries navigate through the steps that should be taken to capture opportunities, navigate troubled waters, turn-around situations, and thus potentially avoid the need for receivership.

Understand the Dynamics of Receivership

"Receivership serves as a last resort strategic tool to preserve assets and navigate through financial distress."

"Get and check references, they should be able to provide a listing of Court appointments that are of the same scope and size of your business.

Talk with the legal community and understand the receiver's marketplace reputation. It is best for all parties when the receiver has the requisite skills and capabilities."

"Monitor the receiver. The receiver must report monthly to the Court. You should get the court transcripts. Request that the receiver have regular meetings with you so you can be aware of your business trends, performance metrics, and the receivers progress towards the court ordered objectives."

Listen to the discussion hosted by Zuber Lawler on how to leverage Restructuring Laws to Improve Cash Flow

Let’s be clear that receivership, which is akin to bankruptcy, is the path of last resort. Depending on the state, a receiver can be assigned on a voluntary or involuntary basis. Since bankruptcy protection is generally not available to cannabis operators, receivership serves as legal recourse for businesses unable to meet financial obligations. A court-appointed receiver acting as a neutral third party, assumes control of the business's assets and operations to safeguard stakeholders' interests and to attempt to preserve its value. Your business becomes part of the receiver’s estate. Therefore, receivers have broad authority defined by court order. Your operating agreements and other similar agreements that bind your management team, are not relevant to the receiver. The receiver manages the business, oversees asset sales, negotiates agreements, and satisfies creditors' claims.

Pick a Receiver with Industry Expertise

Critical to the success of receivership proceedings is the appointment of a receiver possessing relevant industry experience. Upon appointment, the receiver runs your business as they deem fit under the court order. The receiver's role mirrors that of a bankruptcy trustee, with a primary focus on protecting the interests of all or designated stakeholders. Collaborating with a receiver equipped with deep understanding and insight into the cannabis industry enhances the likelihood of achieving court objectives. Again, the receiver will be working towards a court-determined set of objectives. These court-ordered objectives may materially differ from your objectives.

Pros and Cons of Receivership

Receivership sucks from the perspective of the owners and the management team! Why? Because you have NO control!

The receiver is an officer of the Court, effectively an extension of the Court. A receiver needs to convince the Court of their capabilities and each party will get to have input in the selection of the receiver, so once a receiver is appointed it can be difficult to replace them.

Again, before you voluntarily go down this path, speak to specialized counsel and hire a restructuring team to potentially avoid this scenario.

PROS

CONS

Conclusion

Establishing a healthy transformation management program that is built on solid change & project management fundamentals will allow you, as the business owner, to guide your organization forward during shifts in business fundamentals, capturing opportunities, and navigating troubled waters.

Inside a transformation management program are tools that include (a) restructuring and (b) receivership. While it’s unfortunate to use either tool, the restructuring tool kit allows owners to maintain control while receivership does not. Rapid restructuring, when done in a programmatic manner, allows the owners to put some distance between themselves and impacted stakeholders but does not have the power of the court behind it. Receivership has additional tools provided by the Court to stay actions that may be otherwise taken by creditors; however, it comes at a steep financial cost as well as the cost of losing control.

Conclusion

Establishing a healthy transformation management program that is built on solid change & project management fundamentals will allow you, as the business owner, to guide your organization forward during shifts in business fundamentals, capturing opportunities, and navigating troubled waters.

Inside a transformation management program are tools that include (a) restructuring and (b) receivership. While it’s unfortunate to use either tool, the restructuring tool kit allows owners to maintain control while receivership does not. Rapid restructuring, when done in a programmatic manner, allows the owners to put some distance between themselves and impacted stakeholders but does not have the power of the court behind it. Receivership has additional tools provided by the Court to stay actions that may be otherwise taken by creditors; however, it comes at a steep financial cost as well as the cost of losing control.